P.Gankhuu: The message of “Erdenes Mongol” being the most influential company in Mongolia has reached to a global audience

Mongolian Economy Magazine spoke with P.Gankhuu, CEO of Erdenes Mongol LLC.

-Erdenes Mongol LLC is a holding company that brings the largest mining projects altogether. How should we view Erdenes Mongol LLC?

– Erdenes Mongol LLC was established in 2007 to represent the Government of Mongolia in developing the strategically important mineral deposits and making state investment more efficient. It is a Mongolian People’s company. In fact, the government’s decision to issue a preferential share to each citizen was made already. As it is the People’s company to serve the public, our company bears a unique responsibility to work as a fair and transparent economic mechanism in ensuring equal and inclusive distribution of natural wealth. As you said, Erdenes Mongol LLC also can be viewed as a holding company combining major mining projects under its management to develop them efficiently and beneficially.

–I believe that Erdenes Mongol LLC has become the face of Mongolia. How is Erdenes Mongol connecting to the world? How does your operation affect regional development, especially in Northeast Asia?

-In the past, we focused on moving certain large projects in the mining sector forward. The years passed were marked by success, challenge, and struggle to initiate and implement the Oyu Tolgoi and Tavan Tolgoi projects, resolve problems associated with them, and remove the deadlocks and eventually “raise” those two. The company has also been putting extra weight on attracting foreign investments to ensure those projects’ continuity.

Without a doubt, Erdenes Mongol LLC must actively engage in regional cooperation. Indeed, we have several projects in different areas that involve major regional players. For instance, our Shivee Energy Complex Project, whose goal is to build a large scale power plant that supplies energy to domestic and foreign markets such as the Northeast Chinese market, is ready to kickstart as its feasibility study is completed. We are cooperating with the State Grid Corporation of China on the implementation of the abovementioned project.

Mongolia is rich in renewable energy resources. Thus, Erdenes Mongol LLC is participating in regional cooperation on renewable power generation and net exports of green energy. In 2019, we signed a memorandum of cooperation with Rosneft Oil Company of the Russian Federation in this area.

Mongolia must strive to become part of the international production network by supplying value-added products. This means we aim to produce final or intermediate or semi-finished products to the international production network or global supply chain, revitalizing our manufacturing sector.

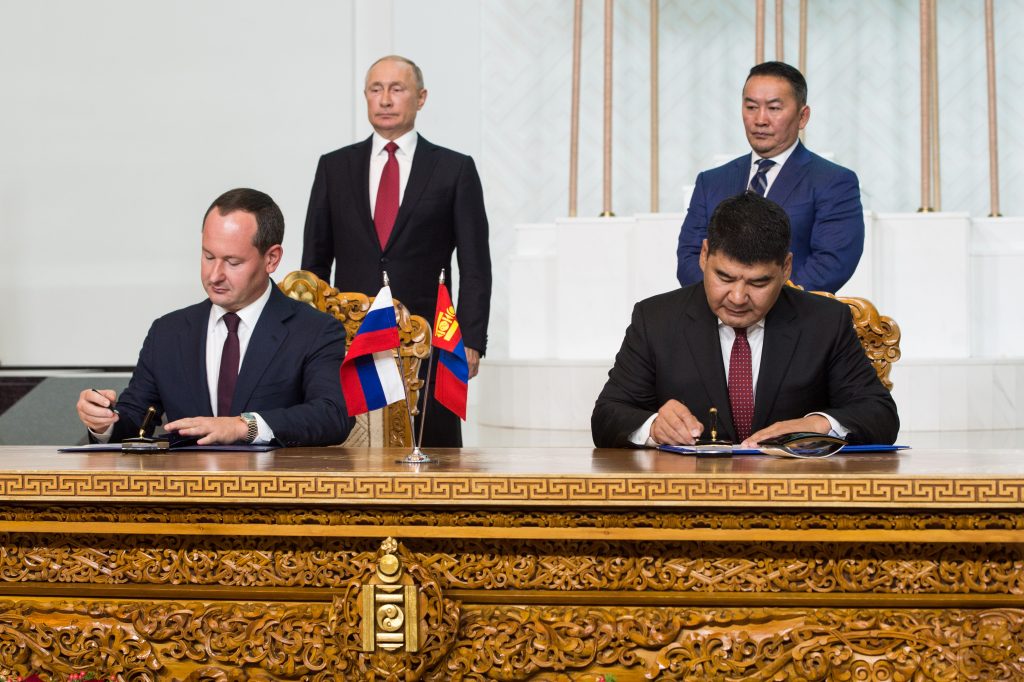

Within the framework of the gas pipeline project, Russia and Mongolia have signed a memorandum of intent to set up a special-purpose company in Mongolia for conducting a feasibility study (August 25, 2020).

–Is there any potential with this regard for Mongolia?

-If we process our minerals and supply to the international production network, there are many opportunities. For instance, there is an avenue to the Northeast Asian supply chain by producing value-added export components. Getting involved in one or some parts of the production network’s value-adding process could generate ‘wealth making’ businesses. When a final product has 100 components or parts, we may need to produce at least 1 or 2 components. We must aim for this.

Activated charcoal is required for car air filters of many types. Let us process our coal and take part in the production network. The processing of coal is finished with coking coal in Mongolia. Yes, we produce a bit of steel from our iron ore, but at a nominal volume. It is time to process our minerals to the next level and produce intermediate or final goods.

We need to produce value-added to effectively take advantage of the global network and utilize our mineral and agricultural resources. In other words, Mongolia has tremendous potential for exporting value-added products such as refined minerals to facilitate regional development and cooperation.

–Erdenes Mongol LLC is an asset management company. Do you think the capability of human resources and the organizational structure are up to the level that you expected?

-In Mongolia, quite a few professionals are working in private asset management companies, raising funds in domestic and international markets, and generating high returns. I could say we are moving in that direction. Our focus is to create a structure and environment that improves accountability and productivity. You know only people with professional experience and skills can responsibly manage assets when the stakes are high. The precondition to manage assets is to have assets. To manage assets, Erdenes Mongol LLC needs to have assets. When it was founded, the company set objectives such as securing assets, acquiring talents, and becoming a holding enterprise. But the most important objective of securing assets was stalled. Without assets, there is no point to have an ambitious goal. A mining company can compete in the domestic and international markets only when it has licenses and fields.

In the past two years, the Prime Minister of Mongolia has given massive support to Erdenes Mongol LLC by granting special licenses on deposits and transferring several other companies’ shares. This enabled us to implement the next level policy. Hence, we could talk about how to manage our assets. The next question, who should manage the assets, arose subsequently. The capacity of our human resources has reached a certain level. One in every four employees is equipped with skills and education that no other state-owned companies have ever had. We have professionals who graduated from foreign and national universities, specializing in asset management, international finance, human resources management, and those gained valuable experience by taking part in the implementation of major projects. However, we still have limited resources, I would say. The main challenge now is to build capacity. We need headhunting and recruit talents and train our staff to strengthen our capacity. The talent pool was limited before. But now, many young professionals are working at the international level, and there are opportunities for them to work at our company to challenge themselves and devote their knowledge and skills to serving their home country.

Erdenes Mongol LLC is collaborating with Rio Tinto, one of the leading mining companies globally, Orano, one of the world’s largest uranium producers, and the State Grid Corporation of China, which operates roughly 90 percent of China’s electricity grids. We also work with Oyu Tolgoi LLC with the latest technologies for an underground mine. Recently, we extended our global cooperation to Gazprom, the largest natural gas producer in the world. Thus, to work with these giants, we need to address issues concerning our human resources. Both domestic and international cooperation will play a critical role in capitalizing on our mineral resources.

We have subsidiaries implementing diverse projects such as gold, silver, copper, iron ore, rare earth elements, natural gas, and methane projects. The participants in those projects are international companies too. Therefore, Erdenes Mongol LLC must manage and balance its various stakeholders’ interests, including multinational companies, domestic and foreign investors, and regional partners. Taking up a leadership role and working at Erdenes Mongol LLC means great responsibility and, at the same time, tremendous opportunity.

А memorandum of strategic partnership and cooperation with UK UZTM-KARTEX LLC, a company based in Russia was signed.

-How is Erdenes Mongol LLC recognized globally? Everyone knows Singapore’s Temasek, Kazakstan’s Samruk Kazyna, Russian Gazprom, and French Areva.

-The first messages reached the global audience for sure. Our company’s name is circulated among and known to government officials, investors, and executives, at a higher level, in the world mining sector as Erdenes Mongol representing Mongolia on Ouy Tolgoi project with Rio Tinto, on the joint project with French counterpart Orana, and the pipeline project with Gazprom.

It is a privilege to be selected in global level projects. The gas pipeline project is a regional project, as you know. The directors of Gazprom told us ‘Erdenes Mongol is the largest holding company in Mongolia. We are happy that your company is selected. You are also lucky because we are number one in the world. We are pleased to work with you’. These words define us and, at the same time, accentuate our responsibility. It is worth noting that we are cooperating with large Japanese, Korean, and Chinese corporations in energy and renewable energy projects.

-What projects are being prioritized at the moment?

-The top priority is given to the projects that could deliver high yields in the short run. The projects were prioritized upon evidence based financial and economic analysis and grouped into short and long term projects.

However, the global economy is facing unprecedented uncertainty due to the COVID-19 pandemic. As a result, investors are taking extra caution when investing.

The risk-averse projects with high yields are gold and silver projects. For the last seven years, the price of gold has been steadily increasing. The initial required investment as not as high as other mineral projects, and the payback period is shorter. Hence, we are working on starting with gold and silver projects to increase our financial capacity and invest in other projects. As of today, Erdenes Mongol LLC possesses six gold and four silver deposit licenses. In today’s environment, it isn’t easy to start projects which require huge investment and takes time to generate a revenue stream.

-Around 70 percent of your operations are directed to future projects. How are you preparing for the implementation of upcoming projects?

-At this stage, our main goal is crystal clear, to raise funding for our projects. Due to our domestic financial market limitation, Erdenes Mongol LLC has no choice but to seek and raise fundings from international markets. We are working on the preparation. First, we need to meet the requirements set by foreign stock exchanges. For instance, the company must provide a transparent financial statement that is audited by international auditing firms and to ensure good governance.

The consolidated financial statement of Erdenes Mongol LLC has been audited by globally renowned financial services firms in the last three to four years. In terms of good corporate governance, we are implementing the ADB’s project on strengthening institutional framework and management capacity. These are for strengthening Erdenes Mongol’s market credibility to raise external funds for our projects.

Erdenes Mongol LLC signed a memorandum of cooperation with Rosseti PJSC.

-Russia and Mongolia signed an agreement on building a gas pipeline that will run through Mongolia. The gas pipeline will open up new opportunities and bring advantages for Mongolia and the region. What is your take on the gas pipeline project?

– In the last 100 years of history, Mongolia signed two agreements on the largest infrastructure development projects. Marshal Kh.Choibalsan, the former Prime minister of the Mongolian People’s Republic, signed the first agreement on Ulaanbaatar Railway in 1946. The Ulaanbaatar Railway that crosses through three countries was designed to facilitate regional integration.

Prime Minister U.Khurelsukh signed the second agreement on Mongolia’s participation in the Power of Siberia 2 pipeline mega-project in 2019. As a result, the gas trunklines will run through Mongolia’s territory. It was, indeed, a historical event.

In the early 1990s, it was a dream to build a Trans-Mongolian pipeline. In the 2000s, we expressed our interest and pleaded multiple times to the Russian government in getting a gas pipeline across Mongolia, stating its cost-effectiveness and the shortest distance of exporting gas to China. This dream is about to come true soon, finally.

Certainly, the gas pipeline project will take a long time to be completed. Hence, we must commence the project as early as possible to turn our dream into reality.