B.Uugankhuu: Aiming to set up an investment fund in Mongolia

Mongolian Economy Magazine spoke with B.Uugankhuu, CEO of Erdenes Asset Management LLC, about their operations and investment management.

-Could you tell our readers about your company and its operations?

-The vision of Erdenes Mongol LLC is “Managing assets, leading growth” which suggests that Erdenes Mongol LLC can be broadly viewed as an asset management company. In 2016, Erdenes Mongol LLC established Erdenes Asset Management LLC to carry investment management activities. In the beginning, Erdenes Asset Management LLC was rarely active. We began actively operating in 2018. Subsequently, after fulfilling the necessary requirements, we were granted a license to carry out investment activities from the Financial Regulatory Commission in November 2019. This means that we have been actively providing our services for only a short period of time.

-In the past 10 months, since Erdenes Asset Management LLC started actively operating, what projects have you focused on?

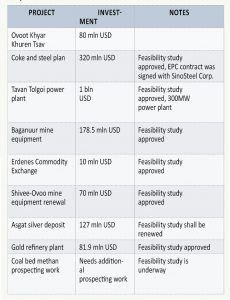

-Erdenes Asset Management LLC provides services to clients on investments to high-yield low-risk projects of various sectors and financial tools on the stock market. Also, we focus on projects of Erdenes Mongol LLC subsidiaries that have a high rate of return in the short-run and could be started as soon as investments are made after feasibility studies. Investors tend to be interested in projects that could yield a high return on investment within two to three years. Due to these reasons, the “Gold Refinery Project” of Erdenes Alt Resource LLC and the “Shivee Energy Complex Project” based at the coal mine of Shivee-Ovoo are currently at the center of our work.

Prime Minister Ch. Khurelsukh visited the gold refinery plant in Kazakhstan and in 2019, he signed a Memorandum of Understanding on Cooperation on the construction of a gold refinery plant in Mongolia. Under the agreement, the Government of Mongolia and Erdenes Alt Resource LLC had to exercise an obligation to secure investments amounting to 81.9 million USD. The refinery plant will allow us to produce pure gold and other precious metals at a low cost.

Furthermore, in order to export electric power to China, Shivee Energy LLC is planning to build a power plant with the capacity of producing 5280 MWh. Extensive efforts are being made to attract investments to build a power plant with 200 MWh capacity based on brown coal from the Shivee Ovoo mines. Currently, we are in talks with two companies from China, one from South Korea and one from the United States with regard to these investments.

Projects

– What challenges are you facing in attracting both domestic and foreign investments?

-The commercial banks account for more than 90 percent of the financial market and the rest by securities firms. The public knows very little about the stock market. For comparison, 70 percent of households in the United States hold assets on the stock market whereas in Mongolia, it is less than 10 percent.

The reasons are the size and maturity of the stock market in Mongolia. Also, there are very few professionals who have experience in investment management. The projects we are working on require investments worth billions or trillions MNT, however, we have a small chance of raising such investments in the domestic market.

-How is the establishment of an investment fund going?

– In Mongolia, there are 27 investment management companies but only around 10 of these companies have prior experience in establishing investment funds. According to statistics, the companies have only created private investment funds and invested mainly in real estate. It can be said that there are currently no examples of conventional investment funds in Mongolia.

Erdenes Asset Management LLC is aiming to establish a closed-end investment fund based on the aforementioned projects. Under the law, an investment fund is registered by the Financial time, we are discussing the terms of the contract.

-The purpose of Erdenes Asset Management LLC is to become one of the competitive investment management companies in the region. What policies and principles do you follow to achieve that goal and how are you preparing your people?

-In order to become a competitive investment company in the region, there are many things that need to be done in Mongolia first. As I mentioned before, the stock market is still immature in Mongolia. Therefore, there is a growing need to prepare future professionals in this area and to collaborate with experienced international advisors and institutions in taking the sector to the next level. After that, promotional activities such as providing information and educating the public will follow. Only when this has happened, can we start talking about entering the regional market.

The investment company carries a great responsibility of managing their stakeholder’s assets. Hence, the investment company must be open, transparent and clear. Erdenes Asset Management LLC attaches great importance to following these principles. Leading global investment companies such as Vanguard, Blackrock, Goldman Sachs follow the same principles. For them, it is not important where they work but how. In other words, the business is based on knowledge, relationship and trust which does not distinguish it from traditional businesses.

In terms of HR, it is critical to have a professional team with wide experience as investors place great trust in us. Therefore, we bear a tremendous responsibility to train the next professionals and hone their skills.