Cryptoconomy

A friend of mine in Austria spent many days wondering what to do with the few euros she saved. Ultimately, there were two choices; to purchase something valuable or put it aside for a rainy day. Eventually, she chose to invest it in something that she barely knew. At the time, bitcoin was attracting many people like a magnet and some people had already started bitcoin mining as well. Others were jealous of their success and newly acquired wealth. The problem was it was brand new and not many people understood what blockchain technology or bitcoin was. Most people were, and some still are afraid of such a phenomenon. My friend, however, was brave enough to purchase few bitcoins before its price hiked and lucky enough to sell them before its price dropped off. Thanks to the income from her bitcoin sales, she has now turned into a businesswoman who owns a brand shop in a large shopping center.

The Bitcoin trend in Mongolia

While world was trying to figure out what cryptocurrency was, Mongolians almost got its own cryptocurrency named “egereg”. It should be mentioned, however, the “egereg” was not e-money, pursuant to the National Payment System Law, which was enacted in 2017. It was stated that E-Money should be non-cash payment instrument approved by the Bank of Mongolia (BoM) and placed in a digital wallet. Cryptocurrency is neither accepted nor prohibited in Mongolia. Yet, it is not considered e-money. “Blockchain technology which Egereg was based on is the main reason it was refused to be accepted as e-money” explains E.Anar, Director General of Payment Systems Department of BoM. “If it is cryptocurrency, and not centrally regulated, then the Bank of Mongolia shall not consider it e-money and not grant approval”.

This incident reveals that consistent understanding and policy on e-money, sometimes understood as cryptocurrency is not on the table globally. It led some people to argue that cryptocurrency is not e-money. This shows that the BoM needs to develop a clearer concept on the e-money and with that shift to the digital economy shall be boosted.

The only official e-money approved by the BoM in the nation at the moment is Candy issued by Mobifinance NBFI. Currently its market volume equaled 5 billion MNT and its 1.4million customers use Candy for paying their phone bill at MobiCom Corporation dealers and purchase products from 6000 members business entities. Additionally, LendMN and ArdCredit NBFIs submitted their requests to issue e-money to the BoM.

Increasing demand of fintech based e-money might have a negative impact on the smooth operation of interbank payment systems. Hence, the BoM adopted the Automated Clearing House (ACH+) system for low-value transactions with the help of the Asian Development Bank on August 2018. Financial transactions of 13 commercial banks and Candy are processed by the system. Number of daily low-value transactions (under 3million MNT) has already reached 100-150 thousand informs official sources. ACH+ system allowed maximum amounts of low-value transaction to reach 5 million MNT. The system is designed to accept payment batches, so that large number of payments can be made at once. The advantage of the system was felt in August when Child Money transactions to 970 thousand accounts were processed within seconds. This usually takes 2 or 3 days.

However, Candy and other proposed e-money are not based on blockchain and not convertible to another currency. Other disadvantages include the e-money being available only in their independent channel. Despite the fact, e-money could have many economic advantages and be a tool to support the development of the fintech sector, Mongolia still lacks policy document and the proper definition of cryptocurrency. It was confirmed by E.Anar, who said Mongolia doesn`t own both the technological and human resource capacity and legal environment in the blockchain technology field. Yet, the BoM is ready to actively work towards carrying out analysis and establishing a payment system when the government policy on blockchain is in place. He also added that fintech companies have requested the BoM to issue a blockchain based digital currency and provide its centralized control. The mobile phone operators, fintech companies and certain banks are working together to issue a stablecoin version of the tugrik based on blockchain technology. They consider that such a move could improve liquidity of the turgik enormously. To do so, a legal basis of considering blockchain based cryptocurrency as e-money should be established. Otherwise, initiatives of the private sector would never be accomplished and never be of service to the mass. It is pointless to argue whether Candy is e-money or if cryptocurrency is not. What matters most now is that we have to reflect the changes of technological breakthrough and development opportunities to our policies and update regulations in a timely manner which will help us not to lag behind from global progress.

“Of 2810 cryptocurrencies registered at CoinMarketCap, international cryptocurrency market, almost 80 percent lack a financial structure and an issuer which make them extremely risky” says B.Khatanbold, CEO of www.trade.mn platform. In such case, one should be responsible for their own risk. On the other hand, a clever decision on cryptocurrency, aproper regulation and centralized control could turn the existing unofficial cryptocurrency trade into an official one, eventually increasing the foreign currency flow to Mongolia. At the same time, sophisticated and intricate regulation on the data usage are to be established, warn the representatives of fintech companies.

For customers, owning a digital wallet or application of every new e-money solution will be terribly problematic. Furthermore, proper definitions on digital wallet, online account and cryptocurrency should be established. Mongolia needs shared and accepted understanding on all these issues to ensure a successful e-money revolution.

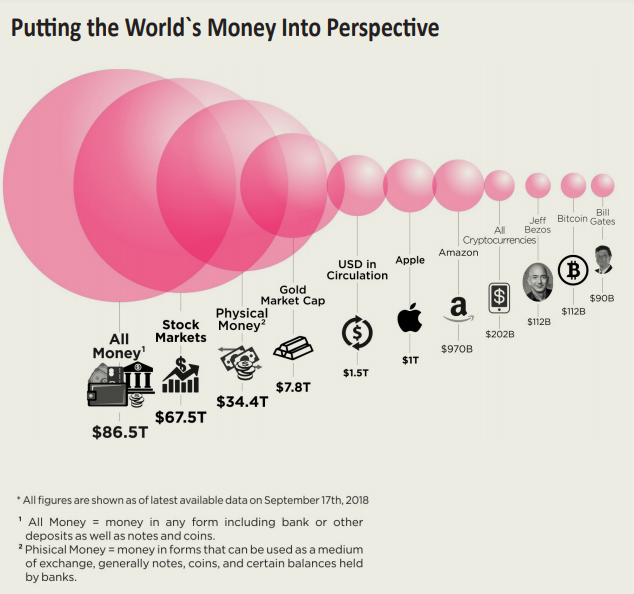

Stable coin version of MNT, based on blockchain to be issued

… A friend of mine stroke gold with Bitcoin. Thankfully, she was also unaffected by the Bitcoin price drop. In Mongolia and in other countries, there are many cryptocurrency miners who went bust. Such gambles could be reduced by a blockchain based and centralized cryptocurrency considering the Central Banks of some influential economies and even the IMF. As for a decentralized cryptocurrency Libra for instance, there must be a proper solution that could eliminate user risk and prevent it from posing a danger to the monetary policy until it is allowed for common use says Bruno Le Maire, France`s Minister of Economy and Finance. In other words, every effort is to be made to establish an appropriate environment capable to block every possible negative consequence and financial risks that cryptocurrency might present. Finally, it is just a matter of time on telling whether cryptocurrency will become the “blood circulation” of the global digital economy.