Development selection

In physics, if you pour six litres of water into a five litre container, you will spill the excess. On the contrary, in economics, an excess can be contained. There are many countries that utilize their surplus revenue to foster their development. Hence, a country with abundant natural resources like Mongolia needs to manage their surplus revenue wisely and to avoid Dutch disease or resource curse. One way to do this is by creating a sovereign wealth fund.

Since the 1950s, Norway has been capitalizing on its abundant oil reserves. On the other hand, the economy was becoming more and more dependent on natural resources and vulnerable to commodity prices in the global market. In order to save surplus revenue, the Parliament of Norway established a pension fund in 1967. Despite that, Norway was still experiencing symptoms of Dutch disease. To ease the symptoms, the Norwegian Parliament took a different approach by establishing another pension fund, the Norway Pension Fund Global, to invest mainly in foreign markets. The fund was designed to invest in high-yield real estates and securities issued by foreign governments, banks and companies. As of today, the Norway Pension Fund Global has over 1.1 trillion USD in assets making it the largest sovereign wealth fund in the world. This is how Norway found the right solution to manage natural resources after going through tough challenges over the course of 40 years.

The Governance model of the Norway Pension Fund Global, ensures the equitable distribution of wealth and is considered to be the most advanced model in the world.

To overcome challenges presented during the transition to a market economy, Mongolia had to rely heavily on the mining sector. Later on, to reduce the dependency on the mining sector, the Government made several attempts to create sovereign wealth funds. In that respect, our authorities have been visiting Norway to learn more about their successful sovereign wealth fund. Unfortunately, we have failed to establish a fund that could come close to the Norway Pension Fund Global. Even to this day, the economy of Mongolia is depending on the price cycles of raw materials. Moreover, government spending increases when revenues increase following higher commodity prices in the global market.

In short, Mongolia is still struggling to turn the surplus revenue derived from the mining sector into advantage. In the past, the Government has only been transferring cash as means of allocating wealth derived from natural resources. This measure has been elevating the consumer prices instead of improving the living standards. The central bank misses its inflation target due to Government decisions to inject the economy with cash. No wonder why people are furious and economists are critical of the soaring debt of Mongolia regardless of abundant natural resources.

Selection result

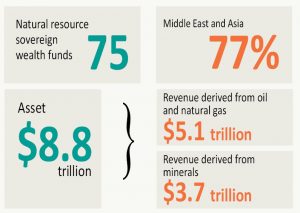

Currently, there are 122 sovereign wealth funds around the world. The total assets of these funds amount to 27 trillion USD which is 1.2 times larger than the US economy or 1.9 times than China’s economy. The majority is funded by revenue from natural resources and the rest by foreign reserves which are used for long term high-yield investments. Countries with limited natural resources like Singapore invest their foreign reserves to achieve high long-term returns.

Currently, there are 122 sovereign wealth funds around the world. The total assets of these funds amount to 27 trillion USD which is 1.2 times larger than the US economy or 1.9 times than China’s economy. The majority is funded by revenue from natural resources and the rest by foreign reserves which are used for long term high-yield investments. Countries with limited natural resources like Singapore invest their foreign reserves to achieve high long-term returns.

Depending on the nature and purpose, a sovereign wealth fund is classified into a stabilization fund, savings fund, reserve investment fund and development fund. Stabilization funds are set up to prevent the budget from commodity price volatility. When the commodity prices are high, excess revenues are saved which is later transferred back if prices fall. Reserve investment funds are established to increase the return on reserves by investing in securities and other assets. Savings funds are designed to save wealth for the future generation. Development funds are created to allocate funds to socio-economic projects such as poverty reduction, infrastructure and economic diversification.

In Mongolia, part of government revenue is being transferred to the Future Heritage Fund, a savings fund, and Fiscal Stability Fund, a stabilization fund. The Law on Future Heritage Fund was adopted in 2016 to save a portion of our resource wealth for the future. With regard to the Fiscal Stability Fund, it allows the Government to set aside surplus revenue derived from exporting mining products for times of revenue shortfall. As of 2020, the assets of two funds amount to 1.1 trillion MNT. Under the law, the state central administrative body has the right to manage these funds.

In theory, Mongolia can create a sovereign wealth fund as many as they want. However, the two previously mentioned funds are not established to ensure equal distribution of resource wealth to every citizen. This can be ensured by development funds.

Turning point

This year, Mongolia made progress in managing the natural resource and its revenues by including a provision on the wealth fund in the Constitution of Mongolia and long term development policy “Vision 2050”. The next sovereign wealth fund will be a development fund which is mainly sourced by royalties on mineral deposits. Furthermore, under Vision 2050, the Government has drawn a development plan for the upcoming 30 years which is going to be reflected in the fund management. According to the Government Action Program for 2020-2024, a fair and equal allocation of resource wealth will be ensured through a sovereign wealth fund.

The Government of Mongolia is encountering numerous challenges in achieving the aforementioned development goals. Under this condition, both private and public bodies are struggling to create jobs and support income of citizens. Mongolia, a country with vast land, has poor infrastructure that worsens the gap between urban and rural areas.

The Government of Mongolia is encountering numerous challenges in achieving the aforementioned development goals. Under this condition, both private and public bodies are struggling to create jobs and support income of citizens. Mongolia, a country with vast land, has poor infrastructure that worsens the gap between urban and rural areas.

If Mongolia could get the full benefit of ambitious projects in the mining sector, it could enhance regional development and job creation. The development of the Gobi region where Oyu Tolgoi and Tavan Tolgoi mines are located can be given as an example. The Government can boost the development and economic recovery of regions but should not repeat the same mistakes made in 2012 and 2016. It must be borne in mind that citizens demand new jobs or opportunities to start their businesses rather than cash transfers.

The fact that newly appointed Parliament and Government are willing to maintain the legacy of previous authorities gives us a stronger hope that this time we might actually succeed in establishing an effective sovereign wealth fund. The only concern is whether the sovereign wealth fund will be managed by a politically independent corporation.

In the Parliamentary Resolution No.2 on measures following the new amendments to the Constitution of Mongolia, it is stipulated that a sovereign wealth fund shall be managed independently and is subject to public monitoring. Adoption of law on sovereign wealth funds which reflects international best practices could lay the foundation for effective management of the wealth fund.

In other words, under the Vision 2050, Mongolia will become a shareholder of globally leading companies and banks in the next 10 years. Then between 2030 to 2040, the Government will ensure a safe and healthy living environment by investing in domestic projects on energy, infrastructure, transportation, water management and communication. If the wealth fund can become a globally recognized sovereign wealth as described in the Vision 2050 within 30 years, then Mongolian citizens will be able to receive dividends on their preferred shares.

Under the law, Erdenes Mongol LLC bears the obligation to generate revenues that will be accumulated in a sovereign wealth fund. The company holds special licenses on deposits that are classified as strategic in the Parliamentary Resolution of 2006. According to the Prime Minister’s order dated November 2019, the operations of Erdenes Mongol LLC must be directed to generating revenue for sovereign wealth funds and in relation to it, necessary rules and regulations must be formulated. In short, Erdenes Mongol LLC will be held responsible for revenue accumulation to the sovereign wealth fund whereas the Government will take over fund management.

Meanwhile, for citizens, sovereign wealth funds have become a topic that falls on deaf ears. However, there is still hope that Mongolia might succeed this time if we could reflect international principles in the law on a sovereign wealth fund. The Santiago Principles is the formulation of principles and practices on sovereign wealth funds around the world. In 2007, the International Monetary Fund coordinated an in-depth research on the effects of sovereign wealth funds on the economy and formulated 24 generally accepted principles. The International Working Group of Sovereign Wealth Funds that consisted of 26 member countries with largest sovereign wealth funds agreed on the Santiago Principles in 2008. They defined a sovereign wealth fund as a special purpose investment fund that is owned by the general government.

The Law on sovereign wealth funds was set as the 16th agenda for the first parliamentary session in Mongolia. If the Parliament decides to become a full member and to incorporate the Santiago Principles in the law, then we will have a transparent, independent and sound governance structure for management of the wealth fund in place. Mongolia has set out an objective to increase the middle class population to 80 percent of total population. A sovereign wealth fund will play a key role in achieving this objective.

Legal framework for sovereign wealth fund

1. Article 6.2 of Constitution of Mongolia

The government policy on the use of natural resources shall be based on long-term considerations while ensuring the right to live in a healthy and safe environment for present and future generations. To ensure equal and fair distribution of wealth, the revenue derived from natural resources shall be accumulated in the Sovereign wealth fund.

2. The Parliamentary Resolution No.2 on measures following the new amendments to the Constitution of Mongolia

1.1.2 Sovereign wealth funds will be savings and development funds. The income to the funds will consist of the revenue from mining activities including royalties deriving from the use of in strategic deposits, sale of shares held by the state, production sharing contracts on natural gas and oil, dividends from shares held by the state and net profits derived from its investments.

1.1.3 An investment management corporation must manage the fund independently, establish good corporate and fund governance and ensure appropriate conditions for public monitoring. The corporation must follow principles of equality and fairness in distributing wealth for current and future generations and dividends on preferred shares.

3. Long term development policy “Vision 2050”

Creating an internationally recognized wealth fund capable of supporting economic diversification, innovation, new technology, human and green development goals.

• 1st stage (2020-2030): Investing in projects with high returns

• 2nd stage (2031-2040): Financing socio-economic goals

• 3rd stabe (2041-2050): Becoming internationally recognized sovereign wealth fund

4. The Government program for 2020-2024

3.2.9 Enforcing amendments to the Constitution of Mongolia and ensuring equal and fair distribution of natural wealth to citizens through a sovereign wealth fund.