From revolution to revolution

History of Mongolia`s banking sector

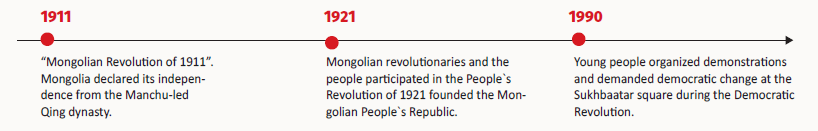

ХХ century was the period of great developments and achievements for Mongolia. Within this short period, Mongolia not only declared its independence, but the country also stepped into the era of modern civilization, urbanization and industrialization. This ultimately lead to freeing of the democratic society, thus began to keep pace with the world. Throughout this century, history has been defined by waves of revolutions and monumental shifts.

Huge tide of reforms and changes overwhelmed all aspects of economic and social life at the time. One of them was the establishment of banking sector in Mongolia. The Trade and Industry Bank of Mongolia was established as a Mongolian and former Soviet Union joint venture on June 2, 1924 in Niislel Khuree. The initial capital of the bank was 250000 golden RUB (equal to 260000 yanchuan at that time) and employed 18 Soviet and four Mongolian officers. The following year, monetary reform was introduced to the Government by the decree of the People`s Great Khural of the Mongolian People`s Republic. Within the framework of the reform, the national currency was formulated as tugrug and the Bank of Mongolia was authorized to put tugrug into circulation. Establishment of the national bank and creation of the national currency have been applauded as a “Revolution without gunshot with the guarantee of independence” by L.Tudev, Hero of Labor and People`s Writer.

In 1954, the Former Soviet Union transferred its own share of stocks in the Trade and Industry Bank to the State of Mongolia, which then became fully owned by the Government of Mongolia. The name of the bank changed to the State Bank of Mongolia and its rule was approved. Under the communist regime, allocation and centralization of monetary resources of the state was strictly regulated in accordance with the plan and the banking sector was centrally coordinated.

System shake up

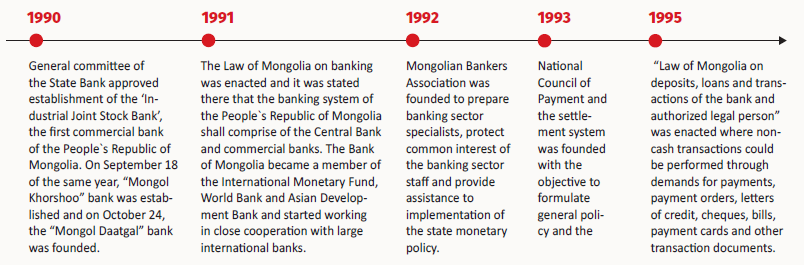

The Democratic Revolution completely transformed the Mongolian society and economy. Mongolia transferred from centrally planned to the free market economy in 1990. For the period of 1924-1991, the Bank of Mongolia solely defined the development of financial intermediation and the financial system. However, a two-level banking system was established in 1991.

A total of 15 banks, including the State Bank, two private banks, the Mongolian-Russian joint bank, and 11 State-owned and incorporated commercial banks were operational in 1994. On top of this, 600 bank branches employing 5000 staff were set up in the capital and rural areas. 1994 marked the start of the banking sector crisis when troubles of previous years began to emerge. Notable incidents include the merge of Mongol Khorshoo-Ard banks and Selenge-

HOTSH banks. Those were first structural change attempts to the banking sector by the BoM. What followed next were liquidation of middle market Invest banks and termination of special operational license of Ikh Zam bank in March 1995. The banking sector crisis deepened in 1996-1999 and the IMF implemented its second phase of the Structural reform Support Program for three years (from June 30 , 1997 to June 29, 2000). Some commercial banks that sprung up like mushrooms in the free market economy went into default during this period.

Main factors to the banking sector crisis in mid-1990s:

• The major reasons for the default and liquidation of banks were the shift to a two-level banking system which was considerably new. BoM supervision system of banks were not fully formed. The management skills and the knowledge of bankers were insufficient and the people were susceptible to frauds.

• Circumstances and operation of many banks were alarming. They had an unsatisfactory understanding of assets and credit quality. There was lousy risk assessment, bad internal control and granted loans without collateral.

• Other issues that affected normal operation of many commercial banks were that the domestic and foreign trade environment were unfavorable. The price system was underperforming and inflation rate was high. Legal arrangement of the exchange rate was uncertain and the fulfillment of required regulations and recommendations were unacceptable.

Stepping into XXI century

After a period of economic transition, the economy of Mongolia progressed steadily. Starting from 2001, the price of gold and copper increased and it coincided with the recovery of the banking sector, alongside the continuation of stable government policy and resurgence of the trade, service and manufacturing sectors.

The economic growth rate remained considerably high until 2008 when Mongolia encountered an economic crisis. Credit risk and non-performing loans were on the rise. The tugrug devalued, business sales slowed down and the banking sector suffered a loss between 2008-2009. The second wave of bank defaults and liquidation started in 2009 and continued to 2015. Therefore, deposit insurance corporation of Mongolia was established and started its operation in 2013 with the mandate to protect depositors` interests and ensure financial stability.

At that time, the BoM learned another invaluable lesson when it implemented a program intended to provide loans to commercial banks at discounted terms to finance particular sectors within the framework of its non-traditional monetary policy. The BoM financed budgetary measures worth of 7.1 billion MNT (nearly 3.9 billion USD, equal to 32.6 percent of the GDP) during 2012-2016 according to the KPMG report. Next comes another political and economic cycle where Mongolia almost went bankrupt and those events are still fresh in the minds of many Mongolians. Then, there came a savior in the form of the IMF and its Extended Fund Facility arrangement is now underway. Asset quality review has been conducted in the Mongolian banking sector within the framework of the arrangement.

Many banks went into default and the banking sector encountered challenges, but since 2000, the sector has seen constant growth. It could be evidenced by financial sector accessibility indicators. Number of branches and account holders in the banks increased steadily and financial services began to be delivered through many platforms including ATMs. Currently, total assets of the banks exceed Mongolia`s GDP and current accounts and savings amount reached 60 percent of the GDP. With more than 1500 branches and 16,000 employees, the banking sector has become one of the main economic sectors in Mongolia.

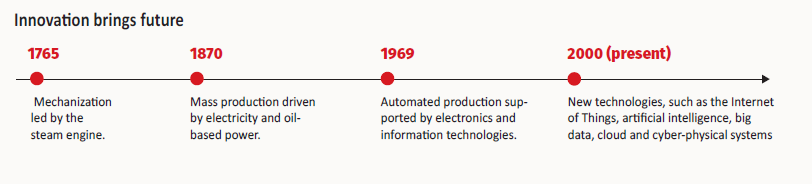

There were four distinct periods of industrial revolution throughout mankind’s history, including the one we`re beginning right now. The fourth industrial revolution has brought in innovations to the banking sector. Financial technology, shortened to fintech has completely revamped our understanding about banks, the sector and traditional financial services. It shall be noted that fintech investment has increased tenfold worldwide in the last six years.

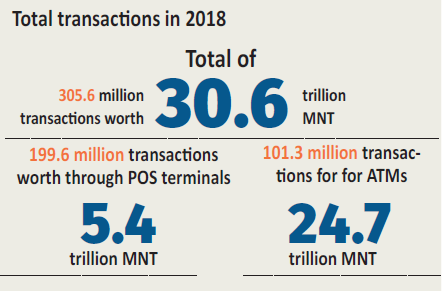

Advanced financial technologies have made services more accessible to the general public in Mongolia. As of the second half of 2018, there are 4.6 million current accounts, 3.2 million deposit accounts and 1.2 million loan accounts in Mongolia. Number of cards issued by the banks jumped to 4.3 million, including 1.3 million active cards in 2018. Number of internet and mobile banking services has seen a continuous increase in the last years. The fact is that two in three people actively use mobile banking services, while one in three people use internet banking services. On top of this, 90 percent of people over 15 own accounts in the banks and the number of mobile banking

service users has increased from 6 to 54 percent in the last three years.

The financial service accessibility indicator is satisfactory and infrastructure environment of thefintech sector of Mongolia is assessed as considerably high as stated in the ING Group research. Fintech solutions such as Candy, Qpay, LendMN, Social Pay and Mostmoney are available to the public with six companies operating in the field. It is clear that the future of the banking and financial sector will be determined by fintech. That leaves us anticipating to

see what kind of advances and innovations the future brings to us.

In brief:

The Trade and Industry Bank of Mongolia (later The Bank of Mongolia) was established as a Mongolian and former Soviet Union joint venture on 24 June, 1924 and tugrug was created as the national currency on 9 December, 1925. However, Mongolia has a rich and ancient history in terms of banking and financial sector. It is not limited only by 95 years. There are many evidences that the coins were in circulation within the Hunnic Empire in late III century. Coins were cast by the decree of Genghis Khan, founder and first Great Khan of the Mongol Empire and banknotes were issued in 1227. More than 100 types of gold, silver , copper, bronze and brass coins were cast and many different banknotes were in circulation in the Mongol Empire. This rich tradition was wiped out after the Empire

broke into many khanates and Mongolia was under the Great Qin rule. Only after the People` Revolution in 1921, Mongolia was able to create its national bank and financial sector. In 1924-1991, the Bank of Mongolia was a monopoly player in the financial market of the country, but, starting from 1991 two-tier banking system was established in Mongolia.