Heartbeat of the Mongolian economy

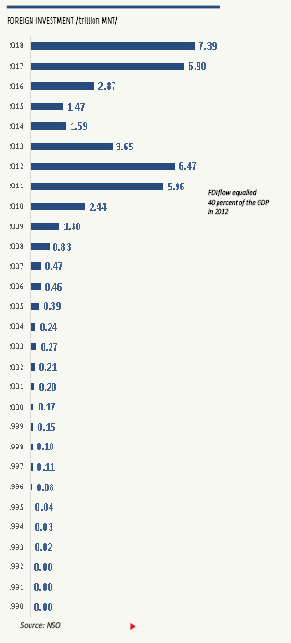

In 2011, the Mongolian GDP growth reached 11.5 percent which seemed shockingly high to the rest of the world. Some people still proudly talk about this growth. However, in reality, it was a lesson rather than an accomplishment. The dramatic growth was the result of the Investment Agreement concluded on October 6, 2009, which brought investments amounting to seven billion USD to the Oyu Tolgoi project. Perhaps, at that time, Mongolia was not yet aware of its investment environment. In correlation with the transition to a free market, the Law on Foreign Investment was adopted in 1993 which enhanced Mongolian foreign trade. Foreign investment amounts to 10 million USD, or at most 25-30 million USD in a year.

From 1990 to 2000, the Mongolian government, in broad terms, had no income from exports or tax. Thus, they had to pay the civil servant’s salary through foreign debt and aid. The state barely managed the operation of power plants, kindergartens, schools with loans from other countries and donor organizations, and grant aid.

Mongolia did not get much attention from the world until the beginning of the new millennium when the mineral commodity prices began increasing and exploration of mineral resources began taking place. Between 2005 and 2008 on average 5,636 companies with foreign investment registered in a year. The amount of foreign investment did not change dramatically. Globally, the flow of foreign direct investments started increasing from 2000. In the UNCTAD report of 2000, 12 percent of the total foreign investments went to developing or to transitional economies. In 2012 the percentage reached 35. In 2011 and 2012, Mongolia was able to attract the highest foreign investments, largely due to the Oyu Tolgoi project.

Mongolia did not get much attention from the world until the beginning of the new millennium when the mineral commodity prices began increasing and exploration of mineral resources began taking place. Between 2005 and 2008 on average 5,636 companies with foreign investment registered in a year. The amount of foreign investment did not change dramatically. Globally, the flow of foreign direct investments started increasing from 2000. In the UNCTAD report of 2000, 12 percent of the total foreign investments went to developing or to transitional economies. In 2012 the percentage reached 35. In 2011 and 2012, Mongolia was able to attract the highest foreign investments, largely due to the Oyu Tolgoi project.

Economist S.Javkhlanbaatar pointed out that under an open policy the basic principles of foreign investments were stipulated in the law enacted in 1993. He continued, “By opening our economy, we have to compete with around 200 countries. Thus, the first principle is not to discriminate against foreign investors by giving an advantage to domestic investors. Furthermore, investors must be treated equally and be able to exchange its currency and withdraw freely. Adopting international principles was a significant step in creating necessary conditions for foreign investments”.

Due to the strong investment flow, the Mongolian economy started experiencing symptoms of Dutch disease. Our economy did not have the potential to utilize a soaring income that reached USD 4.2 billion at its highest. Consequently, excessive demands were created in other sectors. The government expanded its budget expenditures without any restrictions, and social welfare policies prevailed. This became the underlying reason for high inflation in the country.

Money did not keep pouring for eternity. The first stage investment of the Oyu Tolgoi project was about to end shortly, hence, the investment flow has begun slowing down since 2013. Moreover, in the global market, the commodity prices dropped and that disengaged the investors. The numbers of the macro-economy showed that Mongolia lost its grip on the economy and became vastly dependent on external factors. What’s worse, a political mistake of the officials further slowed down the flow of foreign investments.

In May 2012 prior to the Parliamentary election, public debates stocked around national security and foreign investment. In order to halt the upcoming foreign investments in the mining sector at the time, the Law on Foreign Investment in Entities operating in Strategic Sectors was drafted and approved by the Parliament without public hearings. According to the law, any private or public foreign entity that intends to invest in a “strategic” (mining, bank and finance, communication, media) sector is under obligation to get an approval from the Parliament. This is in case an entity is about to purchase more than 49 percent of shares.

In the investment survey of the World Bank, it was revealed that investors had to bear risk because 80 percent of companies do not guarantee investor’s legal rights. In other words, 1.9 billion USD, 90 percent of total investments, were at high risk.

After six months, the law that pushed investors away was repealed. In 1993, a revised Law on Foreign Investment was adopted. The previous law ensured the basic principles of foreign investments. The new law was aimed to foster foreign investment in the mining sector, dispersed economic development, and to put more weight on reducing investment risks. Subsequently, the related laws such as the law on tax, customs, natural resources, and intellectual property were amended as well. Nonetheless, the amendments to the General Taxation Law of Mongolia came into force only this year. S.Javkhlanbaatar pointed out that we have been failing to bear the fruits of revised laws. Mongolia provides its support to investors not only through legislation but also particular investment agreements. Likewise, a tax stabilization certificate is provided to investors. To attract foreign investments, it is crucial to tackling the challenges addressed in the “Doing Business” report by the World Bank. Furthermore, reducing the time spent on dispute resolution and clarifying the strategic sectors that require foreign investments are measures that could meet the investor’s demand – “be clear”.

If we look back in 30 years, it can be concluded that foreign investments pushed the Mongolian development forward. To illustrate, the world learned about the quality of Mongolian cashmere thanks to investments from Japan that enabled the establishment of Gobi JSC. The Mobicom Corporation was the first mobile telecommunications company, and later several mobile phone operators were established. Owing to them, the Mongolian telecommunication infrastructure finally met the international standard. Foreign investment brings unique experience and skills, the biggest investments we cannot put a price tag on. Capital, frontier technology, and valuable knowledge are brought as well. According to an official source, around 180 thousand jobs equal to the total number of civil servant jobs were created as a result of foreign direct investments in 2012. Taking all the statistics and past lessons into account, a foreign direct investment is vitally important for Mongolia, a country with gradually growing industries and undiversified commodity exports. In other words, foreign investment keeps the Mongolian economy’s heart beating.